Leads don’t slip away from a lack of traffic. They slip away in the moments right after intent shows ...

Shortlist Signals: What Buyers Do Right Before They Choose a Vendor

Subscribe Now

Most buying decisions do not end with a big announcement. They close quietly.

A deal that felt active can turn calm overnight. Fewer replies. Fewer meetings. Less visible engagement. A CMO looks at the forecast and feels the pressure rise. Sales asks if the account went cold. Marketing points to earlier engagement and pipeline coverage. The gap sits in the final stretch, right where precision matters.

In many cases, the buyer did not lose interest. The buyer moved into evaluation mode. They narrowed options, built internal alignment, and started comparison conversations that rarely include vendors. That is where vendor shortlist signals show up, and that is where many GTM teams lose sight of what is really happening.

Wyzard, the Signal-to-Revenue AI, connects your GTM stack, captures buyer signals as they happen, then coordinates the right next step across channels. For CMOs who care about win rates, late-stage conversion, and forecast confidence, vendor shortlist signals are among the most valuable signals to spot early.

The Decision Often Happens Before Buyers Say It Out Loud

By the time a buyer says, “We are shortlisting vendors,” that shortlist already exists. Internal research, stakeholder alignment, risk checks, and budget approvals tend to happen away from vendors. Teams often learn the truth late, after the buyer has formed opinions and the buying committee has started leaning one way.

This is why vendor shortlist signals matter. They appear before procurement emails. They appear before the “final demo” request. They show up before the buyer hands you the scoreboard.

From a CMO lens, this creates a familiar blind spot. Marketing drives awareness and demand. Sales runs discovery and demos. The most decisive period sits between those motions, where buyers compare, validate, and decide. That period is the Late Stage, and it is shaped by behavior, not words.

Why Decision-Stage Intent Is Hard to Spot With Intent-Only Tools

Many tools measure interest. That works early. It gets unreliable during shortlisting.

In the late stage, buyers stop exploring the category. They start validating specifics. Their activity becomes quieter and more deliberate. They do fewer public actions. They do more private comparison work. Intent-only signals can look flat during this phase, even though the buyer is closer to a decision than ever.

Intent-only approaches commonly struggle with three gaps:

- Limited context around the account and the deal stage

- Signals scattered across systems, with no unifying view

- Detection without activation, so teams get data but no coordinated next step

This is why vendor shortlist signals require more than a list of “interested accounts.” They require context and orchestration.

Signals Without Action Do Not Win Shortlists

Spotting vendor shortlist signals is useful only when the team responds in a way that helps the buyer decide with confidence. Alerts alone do not move revenue. Dashboards alone do not protect win rates.

This is where a System of Outcomes matters. A System of Outcomes connects intent to a measurable result. It takes scattered signals and turns them into coordinated actions aligned to pipeline outcomes.

Examples of outcome-driven actions triggered by vendor shortlist signals:

- Executive outreach when buying committee activity expands

- A security or risk conversation offered at the moment security pages are visited

- A tailored competitive narrative when comparison behavior spikes

- A fast follow-up that mirrors the buyer’s evaluation questions, not generic “checking in” messaging

The focus stays on helping the buyer complete evaluation, not adding noise.

How Wyzard.ai Identifies Shortlist Signals Early

Wyzard, the Signal-to-Revenue AI, sits across your GTM stack rather than living in a single tool. Signals from CRM, marketing automation, sales engagement, website activity, events, webinars, paid campaigns, and email replies flow into one connected system.

That system is the GTM Intelligence Graph.

The GTM Intelligence Graph links signals to accounts, roles, pipeline stages, and engagement history. It turns scattered activity into a readable narrative. Instead of “visited pricing,” you get context like:

- pricing visits increased over the last week

- two new stakeholders entered the journey

- security content was viewed after the webinar

- a nurture email reply asked about implementation

- the deal sits in late evaluation

This is how vendor shortlist signals become visible early enough to matter.

From there, AI GTM Engineers define outcomes in plain language. For example: “When shortlist behavior appears on an ICP account, coordinate outreach across email, LinkedIn, and sales handoff within the same day, with messaging tied to the observed behavior.” Wyzard.ai then orchestrates that motion through WyzAgents with human oversight.

Vendor Shortlist Signals Show Up Across Every Channel Buyers Use

Shortlisting is multi-surface. Buyers do not compare vendors in one place.

Here are examples of vendor shortlist signals across channels:

- Visiting your website: repeat pricing visits, security page views, implementation content reads

- Lead scanned at an event: follow-on visits from new stakeholders, requests for docs, a jump in account activity

- Clicking a LinkedIn ad: ad engagement followed by targeted product validation pages

- Attending a webinar: questions asked, replay views shared internally, post-event research into pricing and security

- Replying to a nurture email: direct questions about contract, integrations, or onboarding steps

Wyzard.ai captures these signals as a connected story. That connected view is what turns these into an advantage, not a rearview metric.

A Simple Play for Acting on Shortlist Signals

Below is a practical play a CMO can align across marketing, sales, and RevOps without adding friction.

| Pattern of vendor shortlist signals | What it often means | Action to run |

| Pricing, security, implementation pages revisited | Final validation in progress | Sales outreach with evaluation context and one clear next step |

| New stakeholders engage from the same account | Buying committee forming | Role-specific messaging and executive alignment |

| Security documentation interest increases | Risk review active | Route to the right owner for security and compliance answers |

| Replies slow, research deepens | Silent comparison mode | Coordinated multi-channel touch that matches buyer questions |

This play keeps the buyer supported during the period when they are most likely to decide.

Decisions Are Quiet, Behavior Is Not

Buyers rarely announce a decision window. They reveal it through patterns.

Vendor shortlist signals already exist across your GTM stack. The real question is whether your team can detect them early, connect them to context, and act in a way that helps buyers decide with confidence.

Wyzard, the Signal-to-Revenue AI, connects signals across channels, builds account context through the GTM Intelligence Graph, and executes outcome-driven plays shaped by AI GTM Engineers.

If you want to see how – book a demo with Wyzard.ai.

Other blogs

The latest industry news, interviews, technologies, and resources.

February 23, 2026

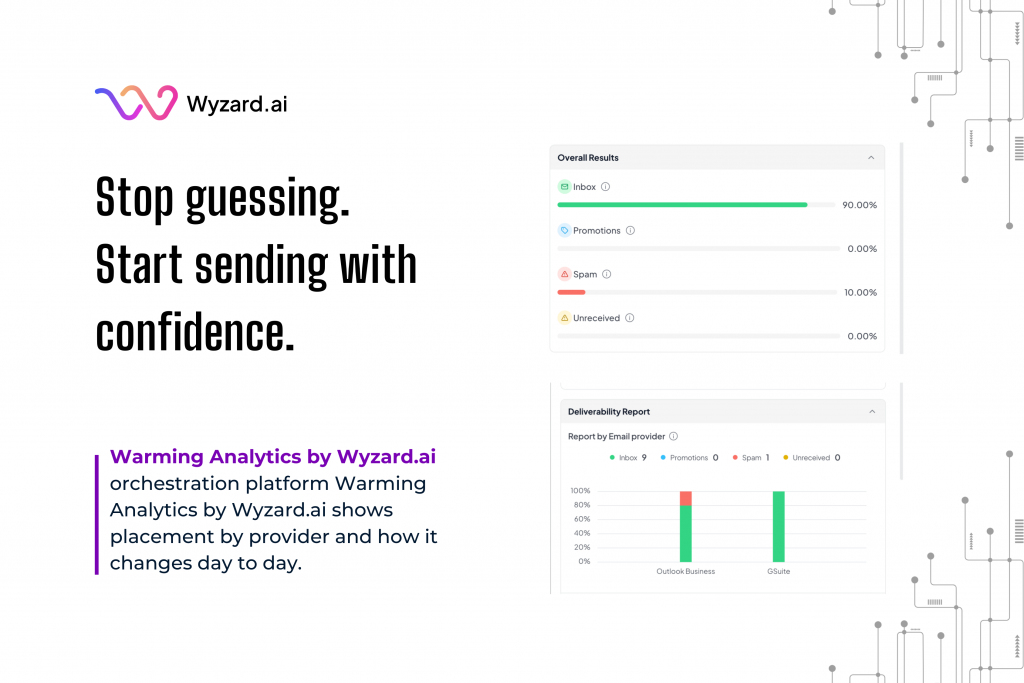

Warming Analytics: Know When a Mailbox Is Ready to Send

Outbound works best when trust stays intact. Many teams ramp up sending, then see replies drop or spam placement ...

February 20, 2026

How To Generate Leads at Events

You spent weeks planning the booth, flew your team across the country, and showed up ready to make an ...

We’ve secured funding to power Signal-to-Revenue AI to GTM teams globally. →

We’ve secured funding to power Signal-to-Revenue AI to GTM teams globally. →