Leads don’t slip away from a lack of traffic. They slip away in the moments right after intent shows ...

Subscribe Now

Your sales team spends hours chasing prospects who vanish mid-conversation. Sound familiar? The root cause isn’t your product or pitch; it’s skipping proper lead qualification.

Without asking the right lead qualifying questions upfront, you’re pouring time into contacts who lack budget, urgency, or decision-making power. Meanwhile, high-intent buyers slip through because you’re stuck in unproductive conversations.

This guide walks through 10 essential questions to qualify a lead effectively. You’ll learn what to ask, when to ask it, and how to use responses to prioritize prospects who actually convert. Whether you’re building your first qualification framework or refining an existing process, these questions help you separate serious buyers from tire-kickers.

Why Lead Qualification Questions Matter for B2B SaaS Teams

Most marketing teams generate plenty of leads. The challenge? Figuring out which ones deserve your sales team’s attention.

Lead qualifying questions solve this by revealing three critical factors: whether a prospect has a genuine problem you can solve, the authority and budget to purchase, and a realistic timeline for implementation. When you skip this step, your pipeline fills with contacts who “seem interested” but never close.

Companies using structured qualification see measurable improvements. Sales cycles shorten because reps focus on prospects ready to move forward. Win rates climb when you’re talking to decision-makers instead of information-gatherers. Your team wastes less time on dead-end conversations.

For growing B2B SaaS companies, this efficiency matters even more. You need to scale revenue without proportionally scaling headcount. That means your existing team must work smarter, and proper qualification is how you make that happen.

What Problem Are You Trying to Solve?

Start here. This lead qualification question cuts through surface-level interest to identify real pain points.

Listen for specific challenges, not vague goals. A prospect saying “we want better lead management” tells you almost nothing. But “our sales team wastes 15 hours weekly chasing cold contacts because marketing can’t filter intent signals” reveals an actual problem.

The specificity of their answer indicates how well they understand their own needs. Prospects with clearly defined problems have usually experienced real consequences, lost deals, frustrated teams, and missed revenue targets. These buyers move faster because they’re motivated by pain, not curiosity.

This question also helps you spot mismatches early. If their problem falls outside your solution’s scope, you can redirect them to better-fit options instead of wasting both parties’ time. Understanding prospect intent signals helps you connect stated problems with real buying behavior.

Why Are You Looking for a Solution Now?

Timing separates serious buyers from researchers. This question uncovers what triggered their search today instead of six months ago or six months from now.

Strong answers include specific events: a recent executive mandate, competitor pressure, system failure, regulatory deadline, or budget allocation approval. These create urgency that drives deals forward.

Weak answers sound like “just exploring options” or “keeping up with what’s available.” These prospects lack compelling reasons to change. They’ll consume your time through lengthy evaluation cycles, then stick with their current approach because switching costs outweigh their modest dissatisfaction.

When prospects describe recent trigger events, probe deeper. “Your new CMO wants this implemented before Q2—what happens if you miss that deadline?” Their response tells you whether this timeline is firm or flexible, which directly impacts deal velocity.

Have You Tried Solving This Problem Before?

Past attempts reveal valuable information about what didn’t work and why. This lead qualifying question helps you position your solution against previous failures.

Listen for patterns. Did their last tool lack key features? Was the implementation too complex? Did their team resist adoption? Each failure point shows you where competitors fell short and where you need to prove your solution differs.

Prospects who’ve tried nothing despite having the problem for years present a different challenge. Low urgency usually means low budget priority. You’ll need a stronger business case justification to motivate action.

When prospects describe failed attempts, validate their frustration before explaining your approach. “That’s a common issue with standalone platforms that don’t connect to your existing tools,” acknowledges their experience and sets up your differentiation naturally.

What Happens If You Don’t Fix This?

This question quantifies the cost of inaction. Strong answers include lost revenue, team inefficiency, competitive disadvantage, or compliance risk.

When prospects struggle to articulate consequences, the problem isn’t urgent. They might be exploring solutions for hypothetical future needs rather than addressing current pain. These deals stall because maintaining the status quo remains acceptable.

Help prospects calculate impact through specific questions: “How many hours does your team spend on manual lead qualification weekly?” “What’s your average cost per lead across all channels?” “How many website visitors bounce before sales engagement?” Numbers make abstract problems concrete.

The best prospects describe cascading consequences. A delayed response to website visitors doesn’t just mean one lost lead; it means damaged brand perception, wasted ad spend, and compounding opportunity cost as competitors capture those buyers. Stopping lead leakage becomes urgent when prospects see the full picture.

Who Makes the Final Decision on This Purchase?

You need to know whether you’re talking to the person who can actually buy or someone gathering information for others.

Decision structures in B2B SaaS typically involve multiple stakeholders: the end user who experiences the problem daily, the manager who controls team budget, the executive who approves expenditures above certain thresholds, and sometimes IT or security teams who must approve new tools.

Ask directly: “Beyond yourself, who else needs to sign off on this decision?” Map out the full buying committee early. Each stakeholder has different concerns you’ll need to address: users care about usability, managers want ROI proof, executives focus on strategic alignment, and IT worries about integration complexity.

If your contact isn’t the decision-maker, determine their influence level. Are they the internal champion who’ll advocate for your solution? Can they bring you directly to the economic buyer, or will your message get filtered through multiple layers?

Single-threaded deals, where you only have access to one person in the organization, carry a higher risk. That person leaves, gets reassigned, or loses internal political capital, and your deal evaporates.

What Budget Have You Allocated for Solving This?

Money conversations make some salespeople uncomfortable. Get over it. Understanding the budget early prevents wasted effort on prospects who can’t afford your solution.

Frame this lead qualification question conversationally: “Have you allocated budget for this project already, or would this be a new investment for next quarter?” This approach feels less aggressive than directly asking “How much can you spend?”

Listen for these scenarios:

Budget approved and allocated means a high-priority initiative with executive support. These deals move fastest when you align timing and pricing.

Budget exists but is not formally allocated, suggesting the prospect needs to build a business case. You’ll need to provide ROI analysis and potentially help them secure approval.

No budget allocated means either the problem isn’t urgent enough to warrant investment, or they’re early in their buying journey. These prospects need nurturing, not immediate sales pressure.

When the budget falls short of your pricing, explore options. Can they phase implementation? Do they qualify for startup or growth-stage pricing tiers? Is there flexibility in scope that reduces costs? Reviving stalled pipeline deals often involves creative budget discussions.

What Does Your Decision-Making Process Look Like?

Understanding how your prospect evaluates and selects vendors helps you navigate their buying journey effectively.

Some organizations have formal RFP processes requiring written proposals and multiple vendor comparisons. Others allow individual managers to select tools within certain budget limits. Many fall somewhere between, with informal evaluation stages that still involve multiple stakeholders.

Key questions to qualify a sales lead in this area:

- “What steps do you typically go through before purchasing software like this?”

- “How many vendors do you usually evaluate?”

- “What criteria matter most in your decision?”

- “Who has veto power if concerns arise?”

Document their timeline: information gathering, demo scheduling, stakeholder alignment, budget approval, vendor selection, contract negotiation, and implementation planning. Each stage takes time, so build realistic close date projections based on their typical process, not your quota needs.

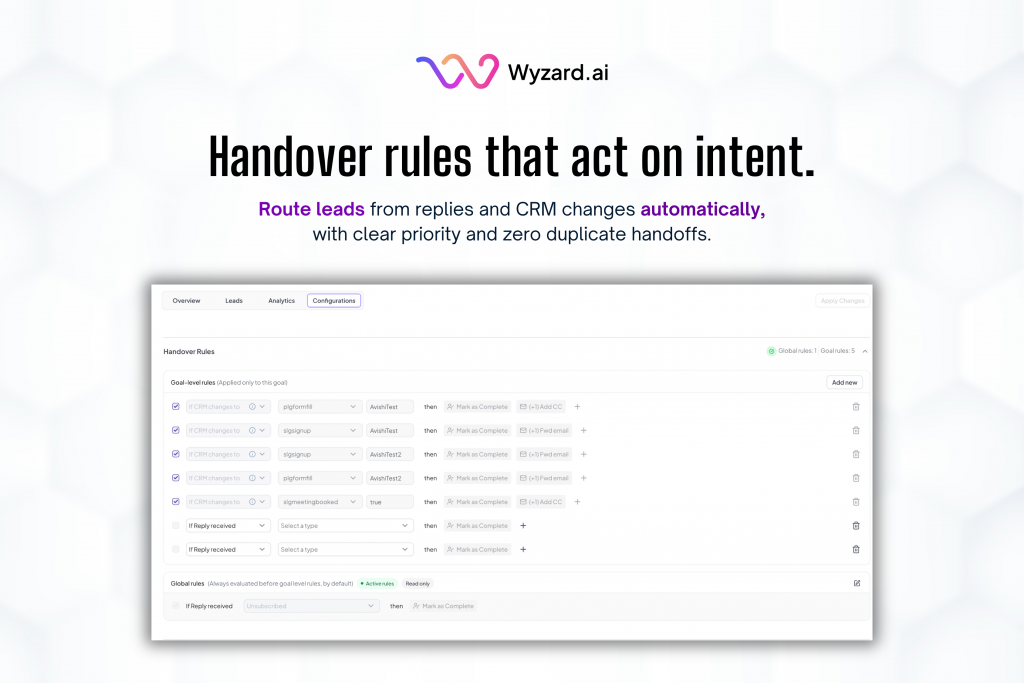

Asking the right questions is only half the battle—effective lead management tools help capture, score, and route answers into your CRM.

Prospects who’ve never purchased this category of solution before need more education and hand-holding. Those who recently bought similar tools can move faster, but also bring expectations from that experience, both positive and negative.

What Other Solutions Are You Evaluating?

This question reveals where you stand in their consideration set and who you’re competing against.

When prospects name specific competitors, research those platforms to understand why they’re attractive. What features resonate? What pricing structures appeal? You can then emphasize your own differentiators without directly bashing alternatives.

Prospects comparing you exclusively to in-house solutions or current processes face a different decision: build versus buy. These conversations center on the total cost of ownership, time to value, and opportunity cost of internal development.

If they’re “not looking at anything else,” probe deeper. Either you’re the only solution they’ve found, which seems unlikely in most markets or they haven’t seriously shopped around yet. The latter suggests early-stage exploration rather than active buying intent.

Avoid getting pulled into detailed competitor comparisons on discovery calls. “That’s a solid platform for companies focused on [their strength]. Most of our customers chose us because of [your differentiation]. Happy to send a detailed comparison if helpful, but first let’s make sure we’re addressing your specific needs.”

What Does Success Look Like Three Months After Implementation?

This lead qualifying question uncovers expectations and helps you determine if your solution can actually deliver what they need.

Strong answers include measurable outcomes: “Our SDRs will spend 30% less time on unqualified leads,” “We’ll engage website visitors within 2 minutes instead of 2 hours,” or “Marketing will pass 40% more qualified opportunities to sales.”

Vague answers like “things will be better” or “the team will be happier” suggest unclear goals. Prospects with fuzzy success metrics struggle to justify purchases internally and tend to experience buyer’s remorse post-sale when results don’t match their unspoken expectations.

Use their success criteria to shape your proposal and implementation plan. If they prioritize speed-to-lead, emphasize real-time engagement capabilities. If they care most about qualification accuracy, highlight your AI-powered scoring and routing features.

This question also surfaces unrealistic expectations early. If they expect your platform to solve problems outside its scope, address that gap now rather than disappointing them after purchase.

When Do You Need a Solution Implemented?

Timeline questions reveal urgency and help you prioritize opportunities accurately.

Prospects with firm deadlines driven by external factors, end of fiscal year, new executive mandate, seasonal business cycles, contract renewals, or compliance requirements, move faster and close more predictably. Build your sales motion around their timeline, not arbitrary quota periods.

Flexible timelines suggest lower urgency. “Sometime in the next 6-12 months” means this isn’t painful enough yet to prioritize. These prospects need nurturing, not aggressive closing tactics. Stay engaged, provide value through content and insights, and watch for trigger events that increase urgency.

When prospects push implementation dates far into the future, understand why. Do they lack a budget until next fiscal year? Are they waiting for current contracts to expire? Do they need internal approvals that take months? These factors determine whether to pursue actively or pause engagement.

For high-intent prospects with urgent timelines, work backward from their deadline to establish milestones: demo completion, stakeholder alignment, contract negotiation, and implementation planning. This creates a shared roadmap that keeps deals moving forward.

Building Your Lead Qualification Framework

These 10 questions to qualify a lead form the foundation of an effective qualification framework. But asking questions isn’t enough; you need a system to capture, score, and act on the insights you gather.

Create a standardized qualification checklist that your team uses consistently. Document responses in your CRM so everyone has context when engaging prospects. Assign point values to key criteria: budget, authority, need, and timeline. Prospects exceeding your threshold qualify for active pursuit, while others move to nurture sequences.

Wyzard.ai helps automate much of this qualification process by capturing buyer signals across your website, email, and other channels. When prospects show high-intent behavior, spending time on pricing pages, returning multiple times, or engaging with specific content, Wyzard triggers immediate, personalized follow-ups that keep conversations moving while your team focuses on closing qualified opportunities.

The platform connects your existing tools to orchestrate the right actions at the right moments. Instead of manual lead scoring and routing, Wyzard’s AI identifies qualification signals automatically and ensures prospects get timely responses that match their journey stage.

Traditional lead qualification relies on forms and scheduled calls. By the time you ask these questions, many high-intent prospects have already moved on to more responsive competitors. Wyzard solves this by qualifying leads through behavioral signals, then prompting the right engagement instantly.

Take Action on Qualified Leads

Asking lead qualification questions is just the starting point. The real competitive advantage comes from acting on what you learn, immediately.

Most B2B SaaS teams lose qualified prospects to delayed follow-up. A lead visits your pricing page, shows clear buying intent, then waits hours or days for a response. Meanwhile, your competitor with faster engagement wins the deal.

Wyzard.ai turns signal capture into revenue by orchestrating instant, relevant actions across your GTM stack. When a qualified prospect shows buying behavior, Wyzard triggers personalized email sequences, schedules meetings with available reps, and alerts your team with full context about the prospect’s journey.

Your qualification framework identifies who to pursue. Wyzard ensures you pursue them before the moment passes.

Stop losing revenue to delayed action and scattered signals. See how Wyzard.ai helps GTM teams capture buyer intent and convert it into a pipeline without scaling headcount. Visit Wyzard.ai to learn how Signal-to-Revenue AI fits your qualification process.

FAQs

Q1. What counts as a qualified lead in B2B SaaS?

A qualified lead shows clear buying signals like visiting pricing pages multiple times, requesting demos, or engaging with product content. They match your ideal customer profile and have budget authority or influence over purchasing decisions.

Q2. How fast should sales teams respond to qualified leads?

Response time matters more than most teams realize. Leads contacted within 5 minutes are 21x more likely to convert than those reached after an hour. Speed wins deals before competitors even know the prospect exists.

Q3. Why do qualified leads go cold after showing interest?

Delays kill momentum. When prospects wait hours for responses, they either move to faster competitors or their urgency fades. The buying window closes quickly in competitive B2B markets.

Q4. Can automated follow-up feel personal to prospects?

Yes, when automation uses contextual data from the prospect’s behavior. Referencing specific pages they visited or problems they researched makes automated messages feel relevant rather than robotic.

Q5. What buying signals should trigger immediate action?

Pricing page visits, repeated product page views, demo requests, and comparison tool usage all indicate active evaluation. These signals demand instant follow-up while purchase intent remains high.

Q6. How does instant follow-up improve conversion rates?

Fast response captures prospects during peak interest and prevents competitor interference. Sales teams connect with leads who still remember why they visited your site and are ready to discuss solutions.

Other blogs

The latest industry news, interviews, technologies, and resources.

February 23, 2026

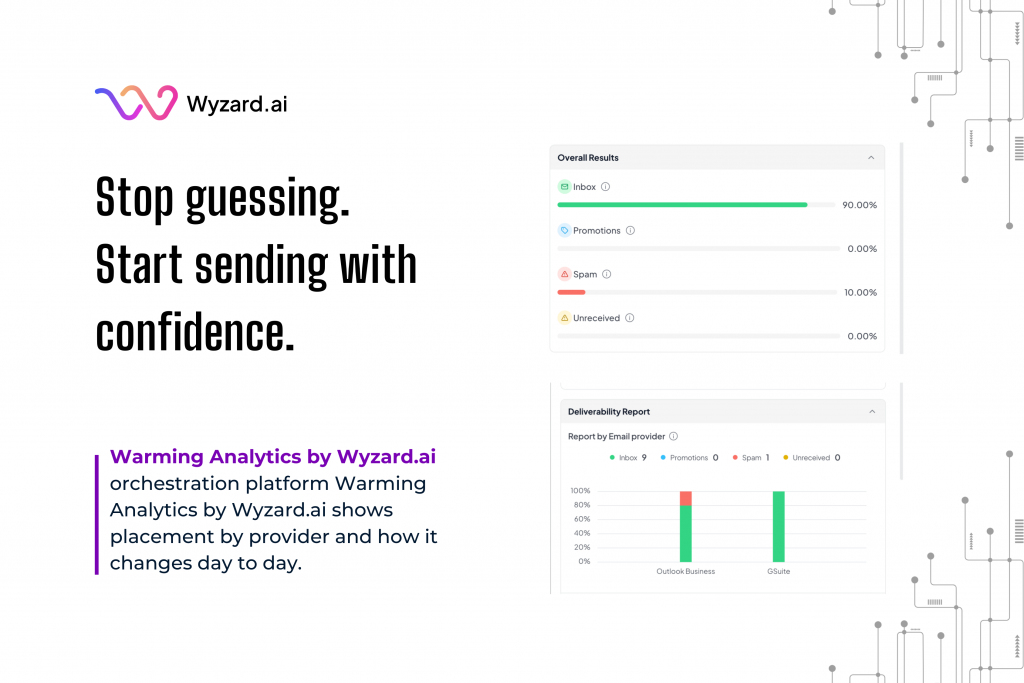

Warming Analytics: Know When a Mailbox Is Ready to Send

Outbound works best when trust stays intact. Many teams ramp up sending, then see replies drop or spam placement ...

February 20, 2026

How To Generate Leads at Events

You spent weeks planning the booth, flew your team across the country, and showed up ready to make an ...

We’ve secured funding to power Signal-to-Revenue AI to GTM teams globally. →

We’ve secured funding to power Signal-to-Revenue AI to GTM teams globally. →