A familiar CMO problem: the quarter looks busy, yet pipeline feels late. You sponsored the event. Ran the LinkedIn ...

Subscribe Now

You’re burning through LinkedIn credits faster than you’d like. You’ve sent dozens of InMails, yet your response rates haven’t budged. Meanwhile, free messages sit untouched in your drafts because you’re not sure if they’ll even land in the right inbox.

Here’s the reality: most GTM teams struggle with LinkedIn outreach, not because they lack good prospects, but because they’re unclear about when to use InMail versus standard messages, and how to make every credit count. The confusion around InMail credits, rollover policies, costs, and strategic timing creates wasted budget and missed opportunities.

This guide breaks down everything you need to know about LinkedIn InMail vs messages, how credits actually work, and when each approach makes sense for your pipeline goals.

What Are LinkedIn InMail Credits?

LinkedIn InMail credits are your premium currency for reaching professionals outside your immediate network. Think of them as paid postage stamps; each InMail you send costs one credit, giving you direct access to someone’s primary LinkedIn inbox, regardless of whether you’re connected.

Here’s what makes InMail different from regular messaging: it bypasses the connection barrier entirely. You can message C-suite executives, hiring managers, or potential clients you’ve never met, and your message lands in their focused inbox, not a separate “message request” folder that rarely gets checked.

Key benefits of InMail credits:

- Reach 1st, 2nd, and 3rd-degree connections without sending a connection request first

- Messages appear in the recipient’s main inbox with higher visibility

- Get your credit back if the recipient responds within 90 days

- Track open rates and engagement through LinkedIn analytics

The catch? InMail is a paid feature tied to LinkedIn Premium subscriptions. Depending on your plan, you receive a monthly allotment of credits, and understanding how to use them strategically determines whether you’re maximizing pipeline potential or just draining budget.

LinkedIn InMail vs Message: What’s the Difference?

The core difference comes down to access and cost. Messages are free but limited to your 1st-degree connections. InMail costs credits but unlocks access to nearly anyone on LinkedIn.

| Feature | LinkedIn Message | LinkedIn InMail |

| Cost | Free | Requires a LinkedIn Premium subscription |

| Who You Can Reach | Only 1st-degree connections | Anyone on LinkedIn (unless they’ve blocked InMail) |

| Credit Usage | None | 1 credit per message (refunded if recipient responds within 90 days) |

| Delivery | Direct to messaging inbox | Primary LinkedIn inbox with higher visibility |

| Subject Line | Not applicable | Yes—increases open rates |

| Best For | Nurturing existing relationships, follow-ups with known contacts | Cold outreach, reaching decision-makers outside your network |

| Response Rates | Varies; depends on relationship strength | Typically higher for targeted, personalized cold outreach |

When to use LinkedIn Messages: You’ve already connected with someone, or they’re an active contact in your network. Messages work best for relationship-building conversations, sharing updates, congratulating achievements, or following up after an initial touchpoint. Since they’re free, there’s no downside to staying engaged with warm leads this way.

When to use LinkedIn InMail: You need to reach someone cold, someone you haven’t connected with yet, but who fits your ICP perfectly. InMail is your tool for breaking into new accounts, pitching decision-makers, or recruiting talent when you can’t afford to wait for a connection request approval.

The strategy isn’t about choosing one over the other; it’s about using both tactically, depending on where prospects are in your pipeline.

How Do InMail Credits Work?

InMail credits function on a monthly allotment basis. When you subscribe to a LinkedIn Premium plan (Career, Business, Sales Navigator, or Recruiter Lite), you receive a set number of credits each billing cycle.

Here’s the credit lifecycle:

- You send an InMail → 1 credit is deducted from your balance

- Recipient responds within 90 days → Your credit is refunded automatically

- No response after 90 days → Credit is consumed permanently

- Unused credits → Can roll over to the next month (with limits based on your subscription)

This refund policy is designed to reward quality, personalized outreach. If you craft a message compelling enough to get a reply, LinkedIn essentially gives you that touchpoint for free.

Do InMail Credits Roll Over?

Yes, InMail credits do roll over to the next month, but with limitations depending on your subscription tier.

Here’s how rollover actually works:

- Unused credits carry forward to the following billing cycle

- There’s a maximum cap on how many credits you can accumulate (varies by plan)

- Credits exceeding your cap expire at the end of each month

- Rolled-over credits are used first before new monthly credits

Example scenario: You have Sales Navigator Core with 20 credits per month. You only use 10 in January. Those remaining 10 roll over into February, giving you 30 total credits (10 rolled + 20 new). But if your rollover cap is 30 credits and you don’t use any in February, you’ll still only have 30 credits in March, not 50.

Why this matters for GTM teams: Rollover policies let you build up a reserve for high-priority campaigns. If you’re planning a big account-based push or targeting a list of enterprise decision-makers, you can bank credits over a few months to execute a concentrated outreach effort without running dry mid-campaign.

Pro tip: Track your credit burn rate monthly. If you’re consistently hitting your cap and losing unused credits, consider adjusting your outreach cadence or upgrading to a plan with higher limits.

LinkedIn InMail Cost: What You Need to Know

LinkedIn doesn’t sell InMail credits individually for most users, you’re paying for a subscription that includes credits as part of the package.

LinkedIn Premium pricing (approximate):

- Premium Career: ~$30/month (5 InMail credits)

- Premium Business: ~$60/month (15 InMail credits)

- Sales Navigator Core: ~$100/month (20 InMail credits)

- Sales Navigator Advanced: ~$140/month (30 InMail credits)

- Recruiter Lite: ~$170/month (30 InMail credits)

Pricing varies by region and promotional offers, so check LinkedIn directly for current rates.

Calculating cost per InMail: If you’re on Sales Navigator Core at $100/month with 20 credits, each InMail effectively costs you $5, assuming you use all of them. But here’s where it gets interesting: if 50% of your InMails get responses, half your credits are refunded, dropping your effective cost to $2.50 per message.

This is why personalization and targeting matter. Generic spray-and-pray InMails waste credits. Thoughtful, researched outreach gets responses, and those responses give you credits back.

Is InMail worth the cost? For B2B SaaS GTM teams, the answer depends on your deal size and conversion rates. If one closed deal from an InMail conversation generates $10K+ in ARR, spending $100-$200/month on a subscription is negligible. But if you’re burning 30 credits a month with zero qualified conversations, you’re better off refining your targeting or switching tactics.

InMail vs Message: When to Use Each

Scenario 1: You’re targeting a VP of Sales at a mid-market SaaS company

- Use InMail if you’re not connected yet and need to bypass the connection request queue

- Use a Message if you’ve already connected and are following up on a previous conversation

Scenario 2: You’re nurturing a warm lead who downloaded your content

- Use a Message to keep the conversation casual and maintain momentum

- Use InMail only if they’re a 2nd or 3rd-degree connection and you need to re-engage them quickly

Scenario 3: You’re running an ABM campaign targeting 50 enterprise accounts

- Use InMail for cold outreach to key decision-makers

- Use Messages for follow-ups once connections are established

Scenario 4: You met someone at a conference and want to continue the conversation

- Send a connection request with a personalized note, then use Messages once accepted

- Avoid InMail—it’s overkill for warm intros

The pattern here? InMail is for breaking through; messages are for building relationships.

Smart InMail Credit Strategy Checklist

Before sending any InMail, ask yourself:

Is this person outside my network? (If not, use a free message instead)

Have I personalized this message with specific details about their company or role?

Does my subject line clearly communicate value?

Am I targeting someone who matches my ICP?

Do I have a clear CTA that’s easy to act on?

Have I checked if this person has an “Open Profile” (allowing free messages)?

To maximize credit efficiency:

- Prioritize high-value targets where one conversation could unlock a major account

- Track response rates monthly to see which messaging angles work best

- Use connection requests first for lower-priority leads to save credits

- Monitor rollover balances so you don’t lose unused credits at month-end

- Test subject lines and message formats to improve refund rates

Pro move: If you’re consistently running out of credits, consider upgrading your plan or tightening your targeting so every InMail goes to a truly qualified prospect.

Maximize Your LinkedIn Outreach Without the Guesswork

Managing InMail credits manually gets messy fast. You’re juggling spreadsheets to track who responded, which credits rolled over, and whether you’re about to hit your cap. Meanwhile, buyer signals from your website, email campaigns, and LinkedIn activity are scattered across multiple tools, and by the time you notice someone’s engaged, the moment to reach out has already passed.

This is where Wyzard.ai’s Agentic InMail changes the game. Instead of manually deciding when to use InMail versus messages, Wyzard.ai captures buyer intent signals in real time and orchestrates the right outreach at the right moment, across channels, including LinkedIn.

When a prospect visits your pricing page, engages with your content, or matches your ICP criteria, Wyzard.ai can trigger a timely, personalized InMail automatically, ensuring you act on every buying signal without burning credits on cold, unqualified leads.

The difference? You’re not guessing when to send InMail or wasting credits on prospects who aren’t ready. Wyzard.ai’s intelligence layer ensures every message, whether InMail or standard LinkedIn message, goes out when engagement likelihood is highest, maximizing both response rates and credit efficiency.For GTM teams looking to scale outreach without scaling headcount, Wyzard.ai turns scattered signals into coordinated action, so you’re always one step ahead of the competition.

LinkedIn InMail vs messages isn’t about picking one over the other, it’s about knowing when each tactic fits your pipeline strategy. Master the credit mechanics, use InMail strategically for cold outreach, and lean on messages for relationship nurturing. And if you want to stop guessing and start converting every signal into revenue, explore how Wyzard.ai’s Agentic InMail can automate the timing, targeting, and personalization that turn credits into closed deals.

FAQs

InMail credits are premium tokens that let you send direct messages to LinkedIn members outside your network. Each InMail costs one credit.

LinkedIn doesn’t sell individual credits. You get them as part of a Premium subscription, ranging from ~$30 to $170/month depending on the plan.

Yes, unused InMail credits roll over, but there’s a maximum cap depending on your subscription plan. Credits exceeding the cap expire.

Messages are free but only work with 1st-degree connections. InMail requires credits but lets you reach anyone on LinkedIn, even if you’re not connected.

Recruiter Lite gives you 30 InMail credits per month. Credits are refunded if the recipient responds within 90 days, and unused credits roll over up to your plan’s cap.

For most users, no, you’re limited to your subscription’s monthly allotment. Some enterprise plans may allow additional purchases, but it’s not standard.

No, InMails land in the recipient’s LinkedIn inbox. However, recipients may receive email notifications about new InMails depending on their settings.

Unused credits roll over to the next month, up to your subscription’s rollover cap. Any credits exceeding the cap expire.

InMails are premium messages that bypass the need for a connection, allowing you to reach almost anyone on the platform directly.

Other blogs

The latest industry news, interviews, technologies, and resources.

January 27, 2026

Find Phone Number by Name and Call Your Leads: Methods and Tools in 2026

You've spent hours tracking down contact numbers for your target accounts. LinkedIn profiles checked. Company directories scraped. Data enrichment ...

January 21, 2026

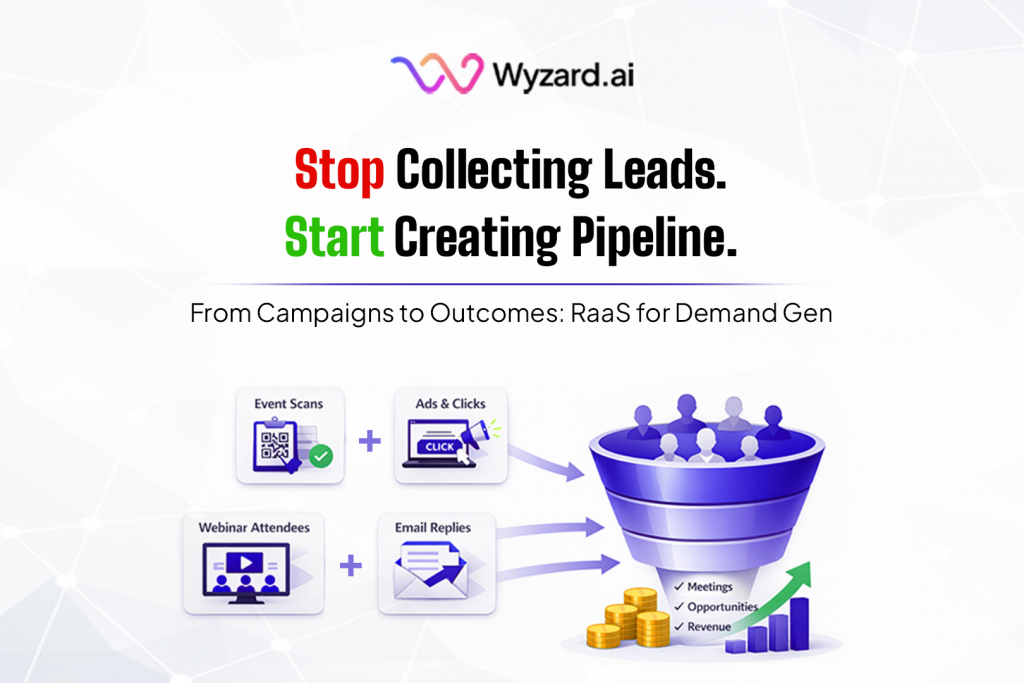

Results as a Service (RaaS) Pricing Models for GTM: Per Meeting, Per Opportunity, or Value Share?

Your CEO asks the question every CMO knows is coming: “We invested in demand. What did we actually buy?...

We’ve secured funding to power Signal-to-Revenue AI to GTM teams globally. →

We’ve secured funding to power Signal-to-Revenue AI to GTM teams globally. →